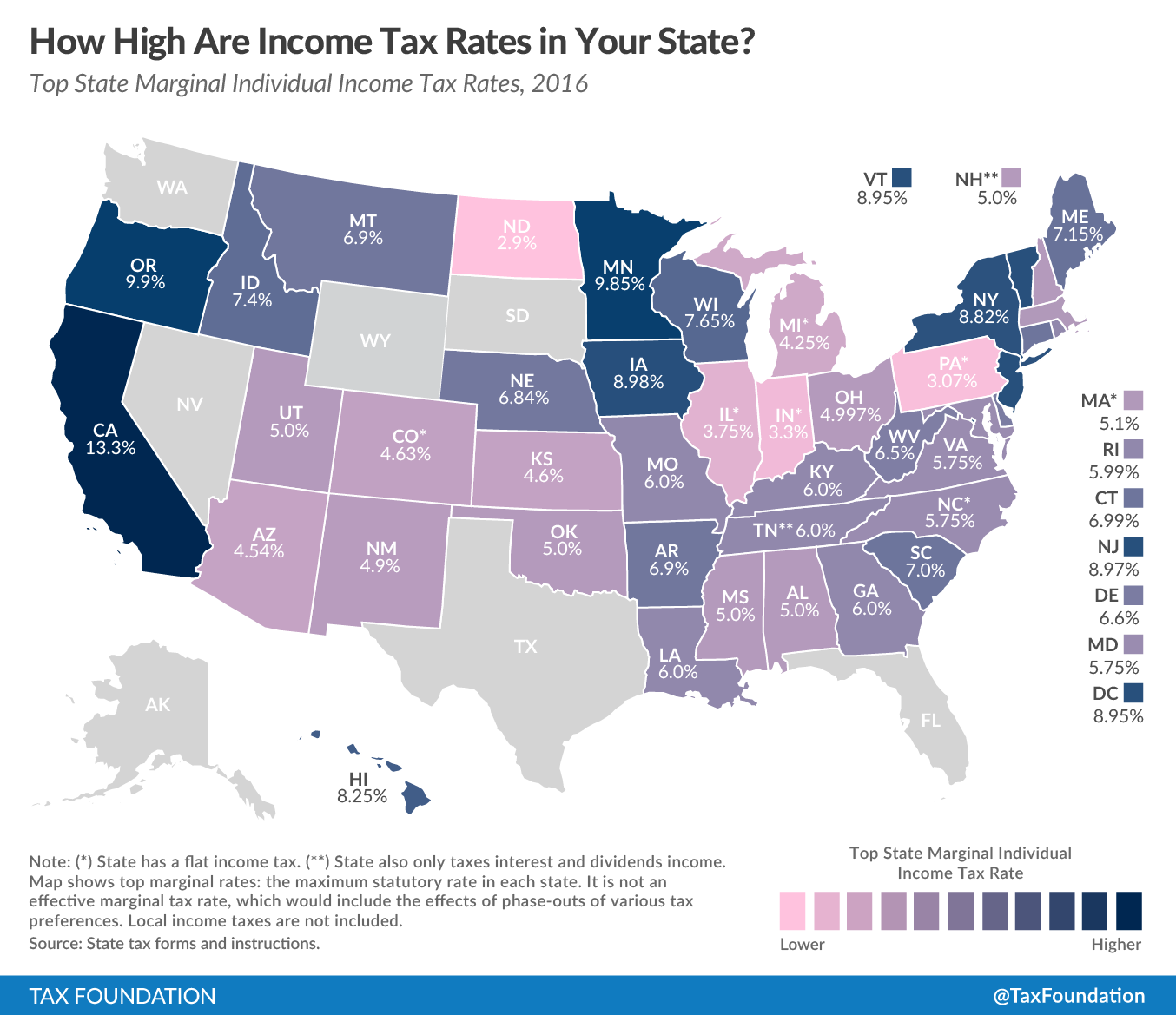

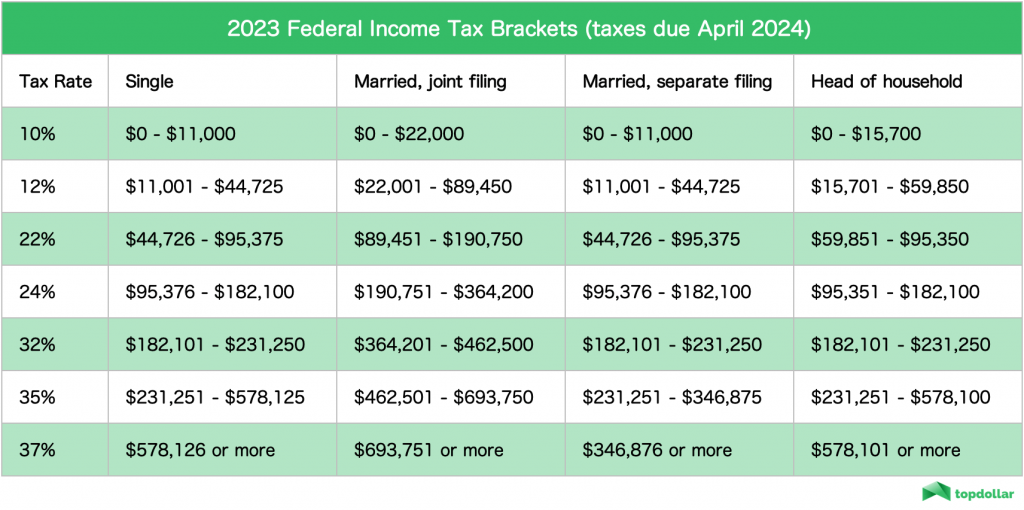

2025 Missouri Income Tax Rate - Tax Rates 2023 To 2025 2023 Printable Calendar, Updated for 2025 with income tax and social security deductables. Missouri has a progressive tax income structure, meaning the tax rate changes based on the amount you earn. Mo Tax Rate 2025 Suzi Zonnya, But missouri’s sales tax is higher compared to other. Like the federal income tax, the missouri state income tax is progressive, meaning the rate of taxation increases as taxable income increases.

Tax Rates 2023 To 2025 2023 Printable Calendar, Updated for 2025 with income tax and social security deductables. Missouri has a progressive tax income structure, meaning the tax rate changes based on the amount you earn.

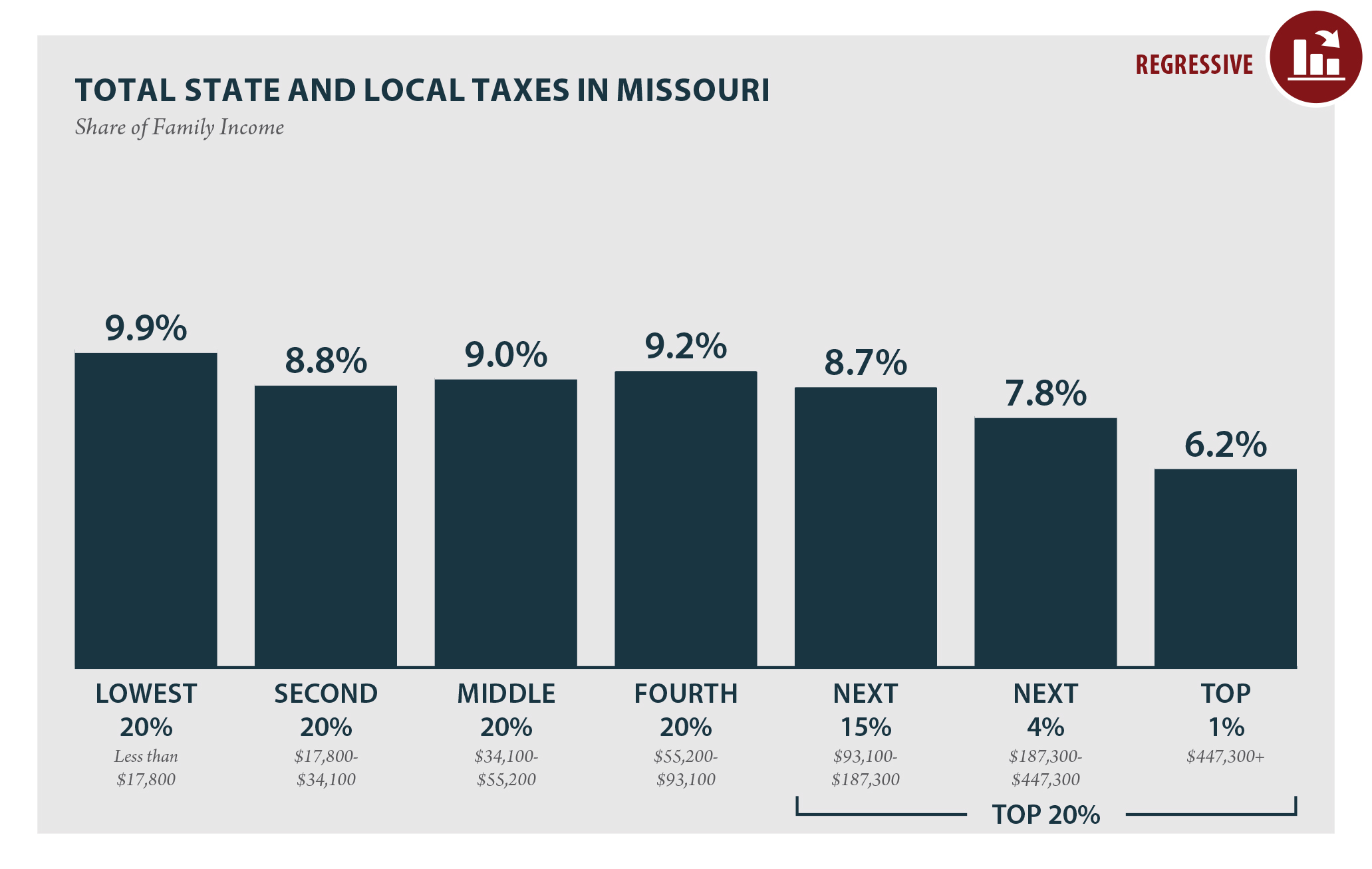

Missouri Who Pays? 6th Edition ITEP, In the calendar year 2025, the top tax rate may be further reduced by about 0.15% from 2023’s tax rate to 4.8%. The income tax rates for the 2023 tax year (which you file in 2025) range from 0% to 4.95%.

State Tax vs. Federal Tax What's the Difference?, Missouri state income tax calculation: Welcome to the 2025 income tax calculator for missouri which allows you to calculate income tax due, the effective tax rate and the.

Missouri Tax Refund Calendar 2025 TAXP, If the same single filer lives in st. The income tax rate for the current tax year is 4.8%.

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

Mystery New Movies 2025. Maula jatt, a fierce prizefighter with a tortured past seeks. Marisa […]

Missouri state tax Fill out & sign online DocHub, That means that your net pay will be $43,881 per year, or $3,657 per month. Updated on apr 24 2025.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

Ca State Tax Brackets 2025 Bobbi Chrissy, To estimate your tax return for 2025/25, please select. Missouri residents state income tax tables for married (joint) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

.png)

Effective january 1, 2025, missouri’s department of revenue reduced its top individual income tax rate from 4.95 percent to 4.8 percent as the respective revenue triggers. The missouri state tax calculator (mos tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

Tax rates for the 2025 year of assessment Just One Lap, Like the federal income tax, the missouri state income tax is progressive, meaning the rate of taxation increases as taxable income increases. This rate is reduced to 4.8% for 2025.

As your income goes up, the tax rate on the next layer of income is higher.